Millions of Americans are coping with stress and anxiety as they deal with the fear and reality of death and disease due to the coronavirus pandemic, as well as the economic fallout as a result of Covid-19.

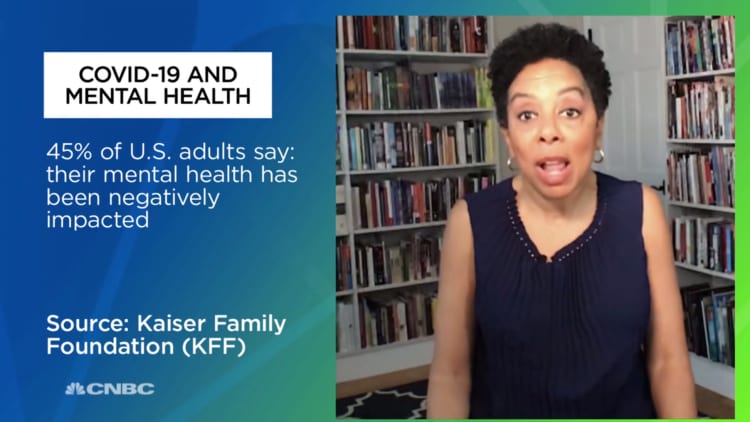

Nearly half (45%) of U.S. adults have reported that their mental health has been negatively impacted due to worry and stress over the virus, according to a poll by the Kaiser Family Foundation conducted March 25–30. Another survey, by the National Foundation for Credit Counseling, found that 69% of Americans ages 18 and up report having financial worries.

"As the coronavirus pandemic continues to impact lives in so many different ways, the economic disruption has placed millions of financially vulnerable people in danger of the most severe hardship," said NFCC's president and CEO Rebecca Steele.

Financial stress and anxiety are increasingly common, psychologists and financial experts say. Even as some states lift "shelter in place" orders and businesses reopen, signaling a slow "return to normal," the tens of millions of Americans who have lost their jobs, been laid off or furloughed during this Covid-19 crisis will still be feeling the economic and emotional toll long after. Millions more will continue to worry that their livelihood could be in jeopardy as companies continue to make adjustments to their bottom line.

According to the NFCC survey, the situations that immensely exacerbate financial worries include not having enough savings, losing a job and the inability to pay debts. Here are some expert tips from the mental health and financial community on how best to cope with these common money stressors.

1. Not enough savings

If you find yourself struggling financially and have a limited emergency fund — or none at all — focus instead on what you can control. "First, carefully examine your expenses and reprioritize your spending. Cut out everything but the essentials — things like mortgage or rent, food, utilities and insurance," said author and certified financial planner Carrie Schwab-Pomerantz, who is also president of the Charles Schwab Foundation. "If you're unable to pay a bill, contact your creditors right away. They may be willing to negotiate a payment schedule or waive late fees."

Create an emergency budget that is completely stripped down to essential spending only. "The stay-at-home orders most of us are facing make it easier to cut a lot of spending, as no one is going to the mall, sporting events or concerts. But there's always the temptation of the internet.

"Keep your online spending in check so you can focus on essentials only," advises Bobby Hoyt, who runs the personal finance website MillennialMoneyMan.com. "Take some time to think about what triggers your spending, and try to cut it out of your day. You might want to unsubscribe from emails, unfollow brands or influencers on Instagram."

More from Invest in You:

Coronavirus crisis is causing financial stress for nearly 9 in 10 Americans

Here's exactly what you need to do if you lose your job

Can't pay your rent? Here's what you should do

2. Job loss

More than 20 million Americans lost jobs in April as the unemployment rate spiked to 14.7%. Roughly 22 million U.S. adults are currently receiving unemployment benefits.

If you haven't already, file for unemployment benefits immediately through your state's program. There will likely be a lag time until you receive your first check. Also, the federal government has increased benefits due to COVID-19, by adding an extra $600 a week until July 31. Go to Careeronestop.org to link to your state's unemployment insurance website and check the details on your state's program.

Make sure you still have health insurance. You could switch to COBRA to receive the same coverage you had under your employer for the next 18 months, but you have to pay for it yourself at a considerably higher cost than you were paying as an employee. "Do some comparison-shopping. You may be able to find a lower cost high-deductible policy through your state's or the federal Affordable Care Act exchange at healthcare.gov," said Schwab-Pomerantz. "Whatever you do, don't be tempted to go without insurance."

And consider other jobs that you may be able to pursue. Use your down time to learn a new skill or start that side-hustle. Education, health care, and technology companies are among some of the industries hiring remote workers right now.

"For some, losing your job could mean losing the ability to pay your bills and take care of yourself and your family. For others, it could be the needed break that they were looking for and allow them to pivot into a new direction," said psychologist George James, associate program director for the Couple & Family Therapy Program at Thomas Jefferson University. "A difficult situation can be viewed in multiple ways. Look for the opportunity in your situation."

3. Inability to pay your debts

Nearly half of U.S. adults currently have credit card debt and 13% of them are not paying anything at all or don't have a plan on how to pay, according to a report by CreditCards.com. Given the scale of the joblessness, CreditCards.com analyst Ted Rossman said "credit cards companies have stopped offering interest-free balance transfers and banks have pulled personal loans because of risk." He advises talking to your credit card company and explaining your current financial situation. "Ask for a break, ask to skip a payment; every bank is offering some sort of assistance," Rossman said.

Consider temporarily paying only the minimum on mortgage/rent, car loans and student loans as well, said Schwab-Pomerantz, whose Schwab MoneyWise website has a list of resources to help during the Covid-19 crisis. More help could be available. You may be able to lower or suspend your mortgage payments for up to one year in some cases. Contact your lender. If you're having trouble paying your rent, talk to your landlord about your situation and your options. Some states and municipalities are providing eviction restrictions for impacted individuals. Many utilities and phone companies have stopped cutting off services for nonpayment. Call them.

From mortgage forbearance to eviction protection to utilities not cutting off services for nonpayment, there are a number of ways to get some economic relief during these difficult times.Carrie Schwab-PomerantzCFP and president of the Charles Schwab Foundation

"Be proactive and contact creditors if you're struggling before they reach out to you," Schwab-Pomerantz said. "From mortgage forbearance to eviction protection to utilities not cutting off services for nonpayment, there are a number of ways to get some economic relief during these difficult times. Don't hesitate to check into — and take advantage — of them. Talk to your mortgage lender or landlord, contact your phone, internet and utilities service providers. Now, more than ever, people are willing to help."

Where to seek additional help

The NFCC report showed most adults would reach out for help if they were in debt or under financial stress, but 23% said they would turn to friends and family first. Only 8% said they would turn first to a professional nonprofit credit counseling agency.

NFCC is one of a number financial planning groups offering free advice and services during this time. You can have an online chat or speak with a counselor from a nonprofit credit counseling agency. The National Association of Personal Financial Advisors and the Financial Planning Association also have certified financial planners and financial advisors available at no cost.

Speaking with a therapist is becoming easier these days, too, with the rise in virtual visits. Most insurance providers offer a variety of mental health resources. Large health insurance companies — such as UnitedHealthcare, Aetna and Cigna — as well as Medicare have increased their capacity and coverage for telehealth visits. For more information about mental health resources, reach out to your health insurance provider. Your workplace also may offer free teletherapy and counseling services through an employee assistance program, and some states have made free mental health hotlines available to residents.

If you believe you are suffering from mental health issues and need immediate help, contact the Substance Abuse and Mental Health Services Administration. Their national help hotline is available 24 hours a day, 7 days a week for free — and does not require health insurance.

SIGN UP: Money 101 is an 8-week learning course to financial freedom, delivered weekly to your inbox.

CHECK OUT: What to do if you think your stimulus check is for the wrong amount via Grow with Acorns+CNBC.

Disclosure: NBCUniversal and Comcast Ventures are investors in Acorns.