Help Isom IGA recover from devasting floods

Now, more than ever, shopper needs are changing. So naturally, if we are going to grow our business we have to be in sync with what they are looking for. And that means retailers have to change too—to keep up, to attract new shoppers, and to serve our existing ones better.

As you make purchases for your family this December, I encourage you to think through how you make decisions about what to buy—and what you expect to happen. After all, retailers are consumers, too, and often the best way to serve our customers is to think like them—and shop like them.

If you are like most Americans, you will buy more from online retailers this year than you did last—almost a quarter of holiday gift buying will be done online in 2018, up from just 5 percent a few years ago. And whether you are buying from an online retailer like Amazon, or from a brick and mortar retailer’s online store, I’d ask you to reflect on what makes the experience so compelling, and how much your expectations as a shopper have changed.

Most shoppers say convenience is the number one reason they are buying more online. In the world of retailing, convenience has always been a driver of shopper choice, tied with selection, price, and service. But let’s break down the latest online shopper research.

Over half of shoppers say that browsing and buying online is their preferred way to shop for most products; and over 60 percent say they would buy more online if they could find the right selection or supply.

Example: How Premium Pet Products Can Bring In Shoppers

In our industry, pet food is a great example of this. Pet is one of the few center-store categories growing in the United States, up almost four percent as a category versus last year. But half that growth is coming from online retailers, many of whom didn’t even exist just a few years ago. And of the amount being purchased online, over half is premium pet products, often at significantly greater price points than in a traditional pet supply or retail grocery.

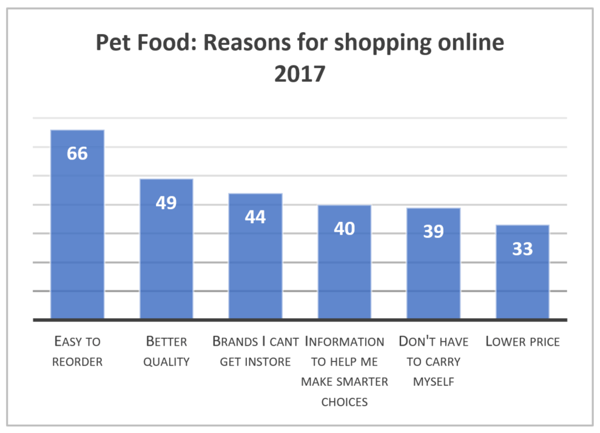

Consider this chart. Price is not the main reason for changing shopper behavior—unique brands, quality, shopper know-how, and convenience are driving this shift.

This pet food insight suggests that if we expanded our assortment into better quality brands, we can attract more shoppers. It also shows how valuable quality and product know-how is.

Imagine taking this data and completely remerchandising our pet aisle. We would stock a higher percentage of grain-free dog foods, and an enhanced selection of natural and high-protein products. We would put signage throughout the department talking about why grain-free is better for your pet, perhaps with links to the IGA.com/pet site.

In our ads we could promote a larger selection of healthier pet products, with or without discounts. And finally, we could put signage up promising to load big heavy bags into the shoppers’ cars so our stores are more convenient.

I’d even recommend we put department-header signs up at the entrance to the pet food aisle saying, “IGA is committed to improving the health of your pet!” and of course, we would use online and social media to talk about the value of switching to grain-free food.

In this example, all we have done is listen to the shopper, find out what is driving them to choose another retailer over us, and reworked our approach to serve them.

None of these ideas are out of the reach of an IGA store.

Inquire. Listen. Plan. Act. It’s how physical retailers like Best Buy are attacking and re-winning shoppers. Best Buy has brought user reviews into their store, printed them right on the tags. They now encourage shoppers to look at Best Buy’s online store while standing in the showroom because often the online descriptions have more information than the display. And they now price to match any online competitor, not just local ones.

Any retailer that wants to take on this challenge in Pet, let me know—I will put our marketing resources at your disposal. But this post is not about pet, and instead about shopper behavior.

We don’t need to feel helpless in the face of changing shopper choices; we just have to be more thoughtful about why they are doing what they do, and build a case for why they should reconsider us for the category. Given changing shopper needs, what is our new plan to win?

You May Also Like

These Stories on From the Desk of

No Comments Yet

Let us know what you think