Talk to Our Financial Counselor: 📞877-402-6322

Millions of Americans have been watching the developments in Washington D.C. closely in recent weeks. With the pandemic and its economic effects lingering, many looked to Congress to pass additional relief, potentially including more stimulus checks to Americans. However, with talks in Congress stalling, President Trump signed executive orders and memoranda on several key issues. Notably, these did not include direct checks. This does not mean that Congress will not further deliberate, and it is still possible that Congress will pass a bill providing additional relief. But for now, here is what you need to know about a few key topics—evictions, unemployment benefits, and student loans—after the President’s recent actions.

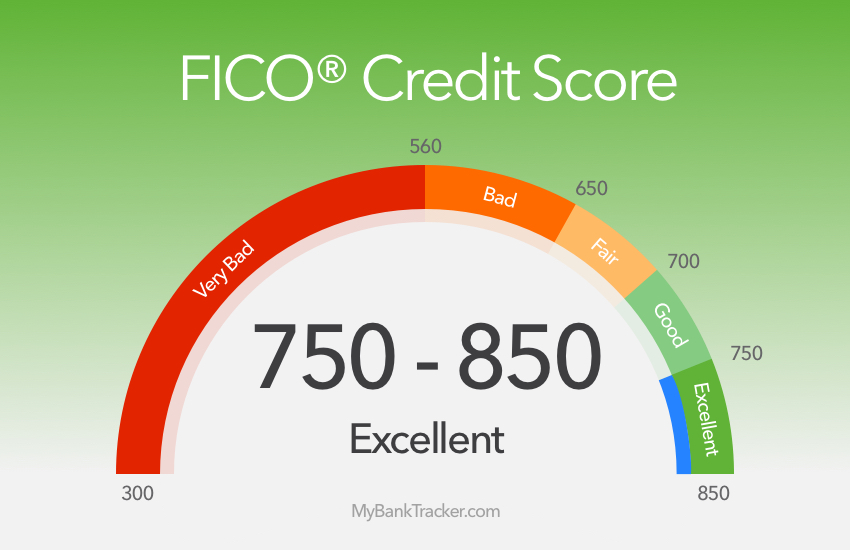

Debt consolidation can be a smart way to pay off debt in some cases. We have written before about specific debt consolidation strategies that you can use, including balance transfers, consolidation loans, and debt management plans (though DMPs are slightly different than true “consolidation”). But despite some of the perks, consolidation has drawbacks. One potential drawback is the impact to your credit score. You might be wondering if consolidation hurts your credit. It turns out that the answer is a mixed bag. Some aspects of debt consolidation can hurt your credit score slightly in the short-term.

Your credit score is calculated using data reported by your creditors to the credit bureaus. This data includes details about your financial behavior, such as credit card usage and payments. However, information about employment, marital status, or assets, like your savings account, does not affect your credit scores. Even an incorrect home address isn’t likely to affect your score. Credit bureaus use your home address to confirm your identity and to match information to you. Although it’s recommended to correct this kind of information, doing so won’t affect your score.

NFCC in the News 📰

-

Do I Need to Declare Bankruptcy? Read More...

-

Everything you need to know about reverse mortgages Read More...

-

It’s unclear if a second stimulus check is coming—here’s how to protect your credit score in the meantime Read More...

Credit scores increase among student loan borrowers

Some borrowers are seeing a boost to their credit score amid a pause in student loan payments. The National Foundation for Credit Counseling offers tips on using it to your advantage.

Around the Country 🗽

According to the U.S. Bureau of Labor Statistics, the unemployment rate fell to 10.2% in July 2020 as 1.4 million people found work. The report credited improvements in the labor market to Americans who resumed the economic activity they had halted during the pandemic. As Congress hashes out a new stimulus plan, it’s important to recognize that the uncertainty the virus brought isn't yet over. And many Americans are still struggling to pay the bills.

Previous Newsletter 📰